In Mexico, cash continues to be one of the most widely used means of payment, especially at the retail level. For a payment solution to be successful, people must get used to it so that it becomes easier for them to gradually abandon the use of cash. Therefore, to achieve this, the evolution of financial services, digitalization and innovation must work in synergy.

The exponential growth of technology has had a major impact on both consumer behavior and the banking distribution model. This has caused banking institutions to move from 100% traditional banking a decade ago to begin their journey towards the digital transformation.

Even though efforts in the world and in the region are underway, there is still much to be done; the task of moving forward with digitalization is not only for banks, it also depends on other key players, such as central banks and regulators.

In developed countries, it is estimated that around 18% of the population makes transactions in cash, while in Mexico, transactions of less than MX$500 are made in cash. Regarding transactions of more than MX$700, 73% are still in cash.

It is crucial to bring businesses closer to electronic means of payment. In doing so, they will begin to receive some electronic money, which provides several benefits, such as reducing the risk of handling cash, making payments without the need to physically go to a place, greater security, and speed. With this, they will begin to move forward and will be able to pay their suppliers electronically. If the cash cycle is broken, there will be a virtuous circle in which there will be more electronic money throughout the system of these businesses, which constitute 90% of the cash transactions in the country.

According to the Mexican Banking Association (ABM), 53% of adults in Mexico do not have a bank account and 7 out of 10 do not have access to credit. According to the National Occupation and Employment Survey, prepared by INEGI, only 1.3% of workers earn more than five times the minimum wage a day.

One of the electronic payment methods that has grown considerably in recent years, especially since the COVID-19 pandemic, is “Buy Now Pay Later” (BNPL), which is a payment method that allows people to make purchases without decapitalizing themselves and without the need to have bank accounts. Thus, a credit offer is obtained to pay in installments and make immediate purchases at affiliated stores.

It is important to highlight that BNPL is mainly focused on young people and entrepreneurs who purchase products online and can make payments in installments without the need of a bank card.

In Mexico, 41% of people are banked and more than 80% have access to mobile electronic devices. Along with the increase of digital services during the pandemic, consumers are making more purchases online. Most of the major BNPL providers have payment options integrated into retailers’ websites, making it easier for customers to choose the “defer payments” option at checkout.

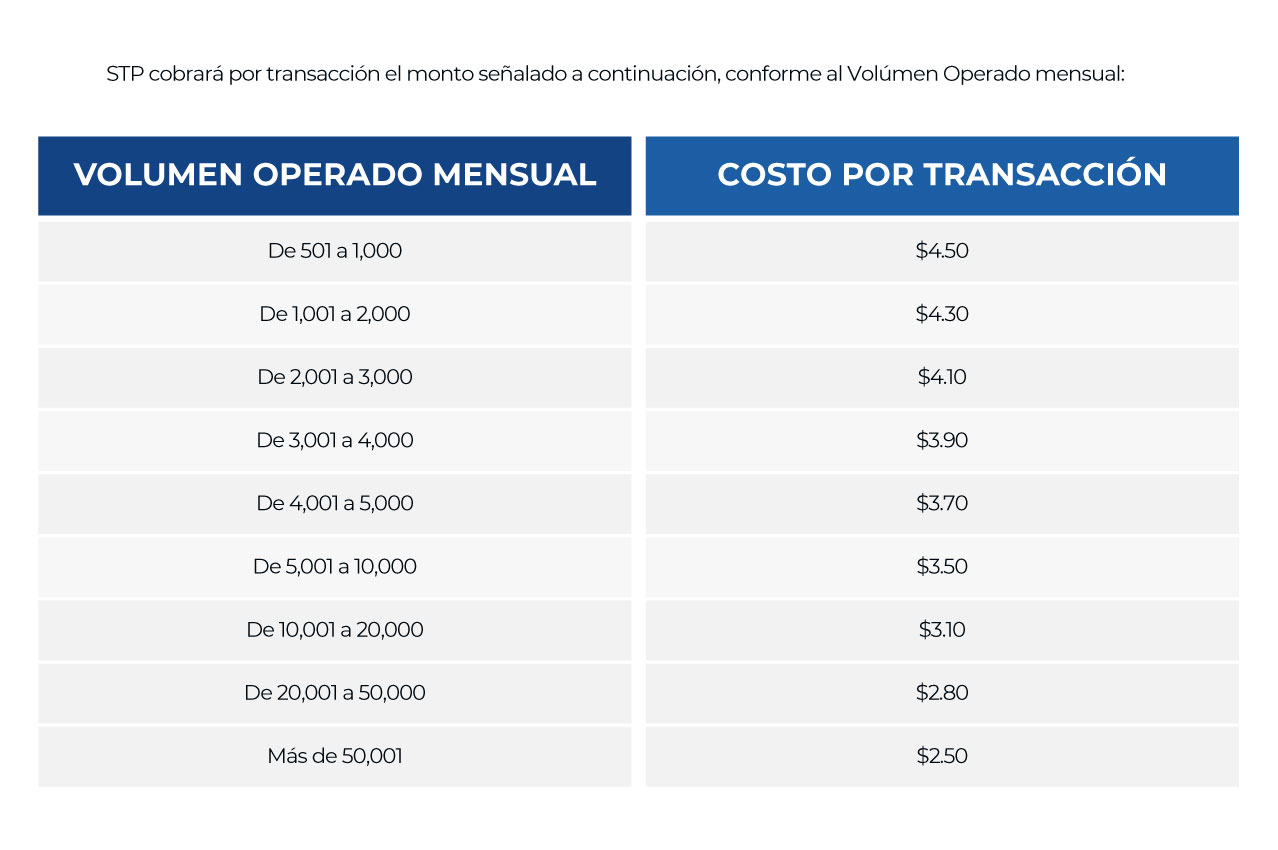

Sistema de Transferencias y Pagos – STP simplifies the payment process for BNPL companies, both for sending funds to the merchant’s bank account and for monthly collections from the end user. STP allows instant payment and receipt of funds through SPEI (the electronic payment system developed by the Central Bank of Mexico) by generating a unique CLABE account for each client so that they can cover their debit payments. In this way, BNPL users can pay from their bank accounts through SPEI transfer 24/7 and their payment will be reconciled in real time.

BNPL consumers are demanding faster, simpler, and more secure payment methods and are transforming online payment options. As many shoppers move to “super apps” in order to manage their finances and investments, technology companies are looking to carve out a larger niche in the banking landscape through mergers and acquisitions.

According to a report by BusinessWire, the Mexican BNPL market has registered considerable growth during the last eight quarters, which is expected to see some global companies, and especially Latin American companies, expand in the country.

Based on the same report, the BNPL growth rate (on an annual basis) for the period 2022-2028 will be 32.1%, which would represent a total of US$15.05 billion by the end of the decade through this payment method in Mexico.

It is important to continue implementing various efforts to implement public policies that encourage digital payments, which are options that help reduce cash and not the opposite. Therefore, it is necessary to continue supporting banking through digital accounts at no cost and the use of simple and fast digital tools that can contribute to this issue in all economic areas of the country.

Fuente: Mexico Business.